Use the Following Information for Questions 98 Through 100 Included in Accounts Receivable Is $1,200,000 Due from a Customer

Multiple Choice

Use the following information for questions 98 through 100.

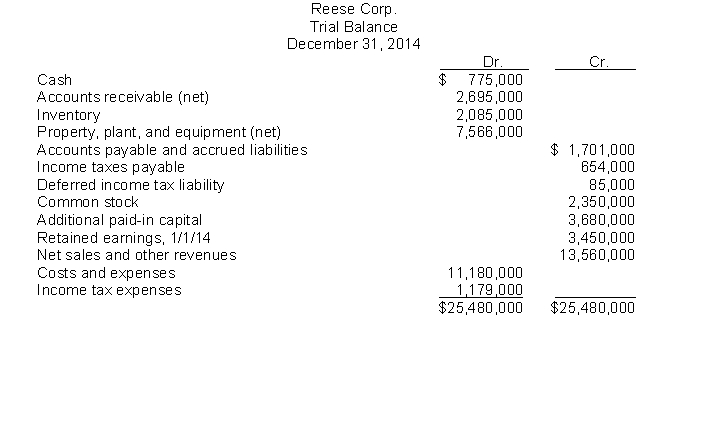

The following trial balance of Reese Corp. at December 31, 2014 has been properly adjusted except for the income tax expense adjustment.  Other financial data for the year ended December 31, 2014:

Other financial data for the year ended December 31, 2014:

Included in accounts receivable is $1,200,000 due from a customer and payable in quarterly installments of $150,000. The last payment is due December 29, 2016.

The balance in the Deferred Income Tax Liability account pertains to a temporary difference that arose in a prior year, of which $20,000 is classified as a current liability.

During the year, estimated tax payments of $525,000 were charged to income tax expense. The current and future tax rate on all types of income is 30%.

In Reese's December 31, 2014 balance sheet,

-The current assets total is

A) $6,080,000.

B) $5,555,000.

C) $5,405,000.

D) $4,955,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q25: For Randolph Company, the following information is

Q26: The financial statement which summarizes operating, investing,

Q27: Use the following information for questions

Q28: Which of the following statements about IFRS

Q29: Companies frequently describe the terms of all

Q31: In preparing a statement of cash flows,

Q32: Which of the following events will appear

Q33: One criticism not normally aimed at a

Q34: An example of an item which is

Q35: Free cash flow is calculated as net