Use the Following Information for Questions 98 Through 100 Included in Accounts Receivable Is $1,200,000 Due from a Customer

Multiple Choice

Use the following information for questions 98 through 100.

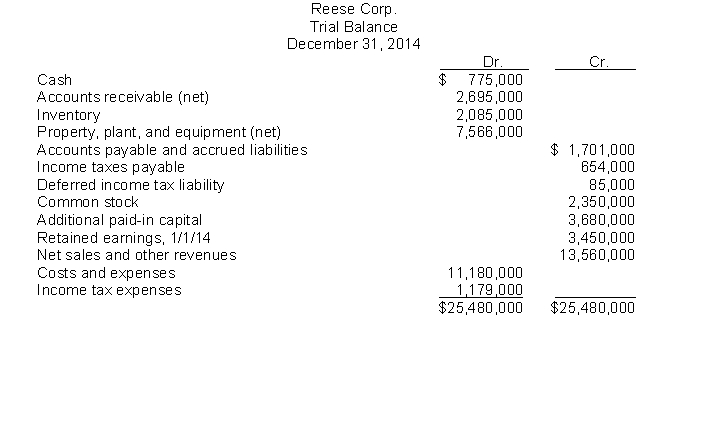

The following trial balance of Reese Corp. at December 31, 2014 has been properly adjusted except for the income tax expense adjustment.  Other financial data for the year ended December 31, 2014:

Other financial data for the year ended December 31, 2014:

Included in accounts receivable is $1,200,000 due from a customer and payable in quarterly installments of $150,000. The last payment is due December 29, 2016.

The balance in the Deferred Income Tax Liability account pertains to a temporary difference that arose in a prior year, of which $20,000 is classified as a current liability.

During the year, estimated tax payments of $525,000 were charged to income tax expense. The current and future tax rate on all types of income is 30%.

In Reese's December 31, 2014 balance sheet,

-The final retained earnings balance is

A) $4,651,000.

B) $4,736,000.

C) $5,176,000.

D) $5,105,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q58: A measure of a company's financial flexibility

Q59: _ ratios measure how effectively a company

Q60: Fulton Company owns the following investments: <img

Q61: Net cash provided by operating activities divided

Q62: Kohler Company owns the following investments: <img

Q64: The balance sheet is useful for analyzing

Q65: Which of the following is a limitation

Q66: Free cash flow is net income less

Q67: Current assets are presented in the balance

Q68: Treasury stock should be reported as a(n)<br>A)