Multiple Choice

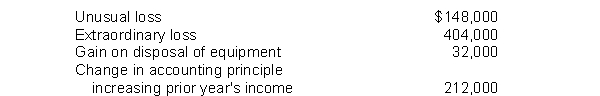

Arreaga Corp. has a tax rate of 40 percent and income before non-operating items of $928,000. It also has the following items (gross amounts) .  What is the amount of income tax expense Arreaga would report on its income statement?

What is the amount of income tax expense Arreaga would report on its income statement?

A) $371,200

B) $324,800

C) $396,800

D) $248,000

Correct Answer:

Verified

Correct Answer:

Verified

Q57: Which of the following is false about

Q58: In 2014, Esther Corporation reported net income

Q59: James, Inc. incurred the following infrequent losses

Q60: Earnings per share should always be shown

Q61: The primary advantage of the multiple-step format

Q63: Dividends declared on common and preferred stock

Q64: An item that should be classified as

Q65: A statement of stockholders' equity includes a

Q66: Norling Corporation reports the following information: <img

Q67: Irregular items and financial statements.The accountant preparing