Multiple Choice

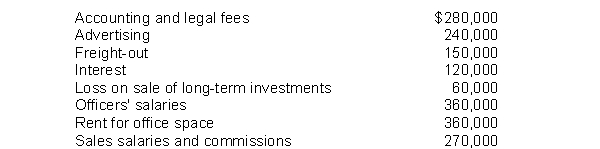

Perry Corp. reports operating expenses in two categories: (1) selling and (2) general and administrative. The adjusted trial balance at December 31, 2014, included the following expense accounts:  One-half of the rented premises is occupied by the sales department.How much of the expenses listed above should be included in Perry's general and administrative expenses for 2014?

One-half of the rented premises is occupied by the sales department.How much of the expenses listed above should be included in Perry's general and administrative expenses for 2014?

A) $820,000.

B) $880,000.

C) $940,000.

D) $1,000,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q72: Palomo Corp has a tax rate of

Q73: Which of the following is not a

Q74: For Mortenson Company, the following information is

Q75: Watts Corporation made a very large arithmetical

Q76: The transaction approach of income measurement focuses

Q78: In 2014, Linz Corporation reported an extraordinary

Q79: Didde Corp. reports operating expenses in two

Q80: An IFRS statement might include all of

Q81: The income statement provides investors and creditors

Q82: Leonard Corporation reports the following information:Correction of