Multiple Choice

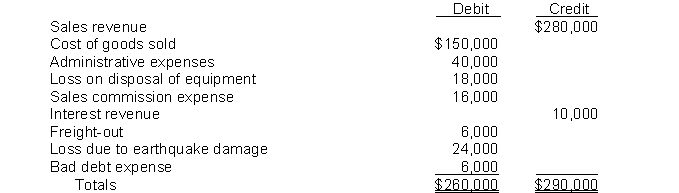

Logan Corp.'s trial balance of income statement accounts for the year ended December 31, 2014 included the following:  Other information:Logan's income tax rate is 30%. Finished goods inventory:January 1, 2014 $160,000December 31, 2014 140,000On Logan's multiple-step income statement for 2014,Income before extraordinary item is

Other information:Logan's income tax rate is 30%. Finished goods inventory:January 1, 2014 $160,000December 31, 2014 140,000On Logan's multiple-step income statement for 2014,Income before extraordinary item is

A) $88,000.

B) $54,000.

C) $37,800.

D) $21,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q66: Norling Corporation reports the following information: <img

Q67: Irregular items and financial statements.The accountant preparing

Q68: Chase Corp. had the following infrequent transactions

Q69: Which of the following is not a

Q70: Income taxes are allocated to<br>A) extraordinary items.<br>B)

Q72: Palomo Corp has a tax rate of

Q73: Which of the following is not a

Q74: For Mortenson Company, the following information is

Q75: Watts Corporation made a very large arithmetical

Q76: The transaction approach of income measurement focuses