Multiple Choice

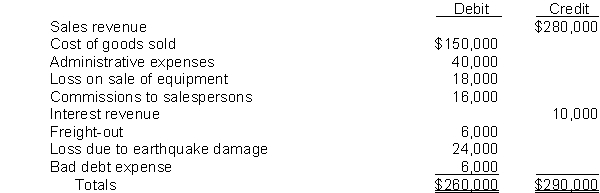

Logan Corp.'s trial balance of income statement accounts for the year ended December 31, 2014 included the following:  Other information:Logan's income tax rate is 30%. Finished goods inventory:January 1, 2014 $160,000December 31, 2014 140,000On Logan's multiple-step income statement for 2014,Extraordinary loss is

Other information:Logan's income tax rate is 30%. Finished goods inventory:January 1, 2014 $160,000December 31, 2014 140,000On Logan's multiple-step income statement for 2014,Extraordinary loss is

A) $16,800.

B) $24,000.

C) $29,400.

D) $42,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q51: Comprehensive income includes all changes in equity

Q52: Where must earnings per share be disclosed

Q53: Moorman Corporation reports the following information:Correction of

Q54: The following items were among those that

Q55: Which of the following is true about

Q57: Which of the following is false about

Q58: In 2014, Esther Corporation reported net income

Q59: James, Inc. incurred the following infrequent losses

Q60: Earnings per share should always be shown

Q61: The primary advantage of the multiple-step format