Essay

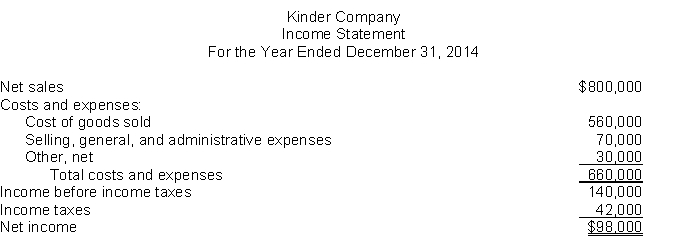

Single-step income statement.Presented below is an income statement for Kinder Company for the year ended December 31, 2014.  Additional information:1. "Selling, general, and administrative expenses" included a usual but infrequent charge of $7,000 due to a loss on the sale of investments.2. "Other, net" consisted of interest expense, $10,000, and an extraordinary loss of $20,000 before taxes due to earthquake damage. If the extraordinary loss had not occurred, income taxes for 2014 would have been $48,000 instead of $42,000."4. Kinder had 20,000 shares of common stock outstanding during 2014.

Additional information:1. "Selling, general, and administrative expenses" included a usual but infrequent charge of $7,000 due to a loss on the sale of investments.2. "Other, net" consisted of interest expense, $10,000, and an extraordinary loss of $20,000 before taxes due to earthquake damage. If the extraordinary loss had not occurred, income taxes for 2014 would have been $48,000 instead of $42,000."4. Kinder had 20,000 shares of common stock outstanding during 2014.

InstructionsUsing the single-step format, prepare a corrected income statement, including the appropriate per share disclosures."

Correct Answer:

Verified

Correct Answer:

Verified

Q29: The following information was extracted from the

Q30: Both U.S. GAAP and IFRS discuss income

Q31: Logan Corp.'s trial balance of income statement

Q32: Companies often restrict retained earnings to comply

Q33: What might a manager do during the

Q35: Which of the following is true of

Q36: Income statement form.Wilcox Corporation had income from

Q37: Sandstrom Corporation has an extraordinary loss of

Q38: Dole Company, with an applicable income tax

Q39: In order to be classified as an