Essay

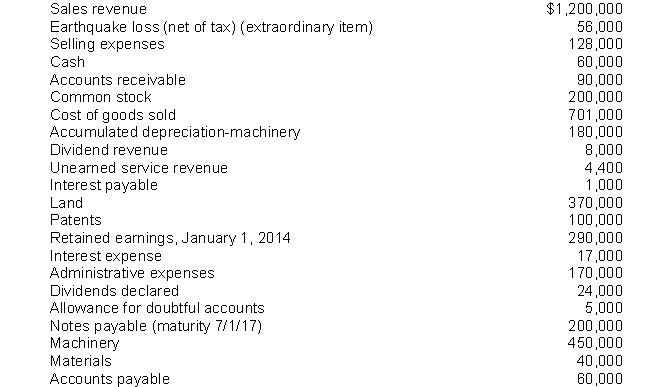

Income statement and retained earnings statement.Porter Corporation's capital structure consists of 50,000 shares of common stock. At December 31, 2014 an analysis of the accounts and discussions with company officials revealed the following information:  The amount of income taxes applicable to ordinary income was $57,600, excluding the tax effect of the earthquake loss which amounted to $24,000.

The amount of income taxes applicable to ordinary income was $57,600, excluding the tax effect of the earthquake loss which amounted to $24,000.

Instructions

(a) Prepare a multiple-step income statement.

(b) Prepare a retained earnings statement.

Correct Answer:

Verified

Correct Answer:

Verified

Q101: Perry Corp. reports operating expenses in two

Q102: For the year ended December 31, 2014,

Q103: Multiple-step income statement.Presented below is information related

Q104: The occurrence which most likely would have

Q105: The following information was extracted from the

Q107: Gross billings for merchandise sold by Lang

Q108: The income statement is useful in assessing

Q109: Under IFRS, both revenues and expenses and

Q110: Korte Company reported the following information for

Q111: Leonard Corporation reports the following information:Correction of