Short Answer

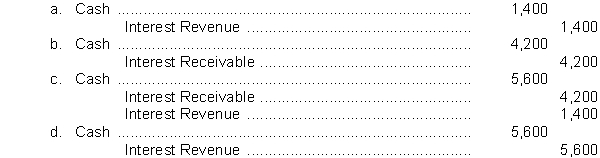

A company receives interest on a $70,000, 8%, 5-year note receivable each April 1. At December 31, 2014, the following adjusting entry was made to accrue interest receivable:

Interest Receivable 4,200

Interest Revenue 4,200

Assuming that the company does not use reversing entries, what entry should be made on April 1, 2015 when the annual interest payment is received?

Correct Answer:

Verified

Correct Answer:

Verified

Q21: Adjusting entries are necessary to<br>1. obtain a

Q22: In November and December 2014, Lane Co.,

Q23: Which of the following would not be

Q24: Terminology.In the space provided at the right,

Q25: An accrued expense can best be described

Q27: Lopez Company received $14,400 on April 1,

Q28: An adjusted trial balance that shows equal

Q29: Gibson Company paid $12,000 on June 1,

Q30: Pappy Corporation received cash of $24,000 on

Q31: Adjusting entries that should be reversed include<br>A)