Short Answer

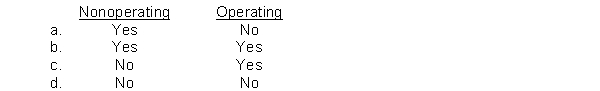

The FASB's conceptual framework classifies gains and losses based on whether they are related to an entity's major ongoing or central operations. These gains or losses may be classified as

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q60: When should an expenditure be recorded as

Q61: Company A issuing its annual financial reports

Q62: The basic accounting concept that refers to

Q63: The IASB and the FASB are working

Q64: Financial information demonstrates consistency when<br>A) firms in

Q66: A company has a performance obligation when

Q67: Product costs include each of the following

Q68: The IASB has issued a conceptual framework

Q69: Issuance of common stock for cash affects

Q70: Timeliness and neutrality are two ingredients of