Essay

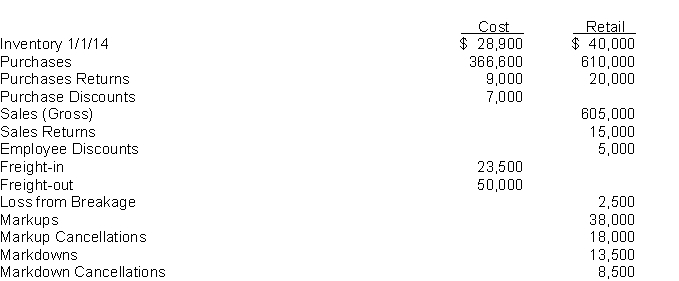

Conventional and LIFO Retail Method.Note to Instructor. Part B is based on Appendix 9-A.A. Landmark Book Store uses the conventional retail method.

InstructionsGiven the following data, prepare a neat, labeled schedule showing the computation of the cost of inventory on hand at 12/31/14.  B. Landmark Book Store has decided to switch to the LIFO retail method for the period beginning 1/1/15.

B. Landmark Book Store has decided to switch to the LIFO retail method for the period beginning 1/1/15.

InstructionsPrepare a schedule showing the computation of the 12/31/15 inventory under the LIFO retail method adjusted for price level changes (i.e., dollar-value LIFO Retail.) Without prejudice to your answer in requirement A above, assume that the 12/31/14 inventory computed under the LIFO Retail method was $40,000 and $27,500 at retail and cost, respectively, for purposes of this requirement. Data for 2015 follows:

Correct Answer:

Verified

Correct Answer:

Verified

Q30: Why are inventories included in the computation

Q73: On June 15, 2014 Stine Corporation accepted

Q74: Which group of items listed below should

Q75: Leases.On January 1, 2015, Foley Company (as

Q76: Which of the following transactions would be

Q77: Purchased goodwill represents<br>A) excess of price paid

Q79: Use the following data for questions 10

Q80: Durler Company's account balances at December 31

Q81: On December 31, 2014, Hill Company, which

Q83: Use the following data for questions 10