Multiple Choice

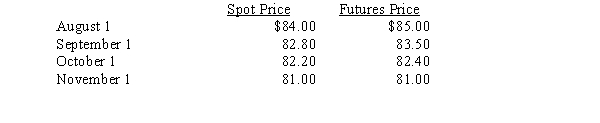

On August 1, an oil producer decided to hedge the fair value of its inventory by acquiring a futures contract to sell 100,000 barrels of oil on November 1 for $85.00 each. Price data follow:  What is the current period change in time value that would be recognized in earnings as of October 1?

What is the current period change in time value that would be recognized in earnings as of October 1?

A) $260,000

B) $110,000

C) $50,000

D) $60,000

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The notional amount of a derivative instrument

Q3: On January 3, 20X4, Realto Company issued

Q4: Both forward contracts and futures contracts provide

Q5: During the second quarter of 20X5, Bertke

Q15: An option<br>A)is not traded on an organized

Q19: The difference between the strike price of

Q22: A fair value hedge may be used

Q46: Which of the following is not true

Q49: Interest rate swaps<br>A)are a type of Futures

Q58: A hedge to avoid the potential unfavorable