Essay

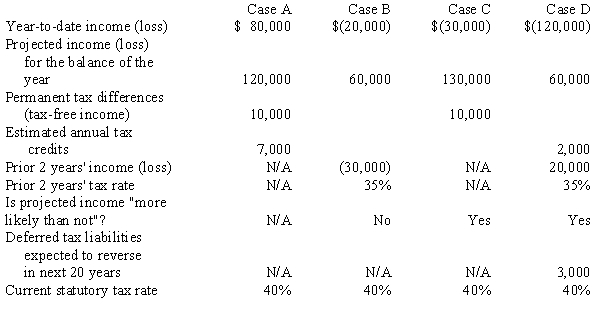

For each of the following independent cases, determine the estimated effective tax rate to be used for the current quarter's interim statements.

Correct Answer:

Verified

Estimated effective tax rate = net tax ...

Estimated effective tax rate = net tax ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Lancaster Inc. expects to have taxable income

Q7: Millstone Company's first-quarter 20X3, pretax income is

Q8: The management approach to segmental reporting<br>A)focuses on

Q8: Ansfield, Inc. has several potentially reportable segments.

Q9: The following lists account titles found on

Q35: The primary emphasis of interim reporting is

Q37: In order to generate interim financial reports

Q40: Which of the following is not a

Q42: During the first quarter, a company's application

Q57: Which of the following best describes how