Essay

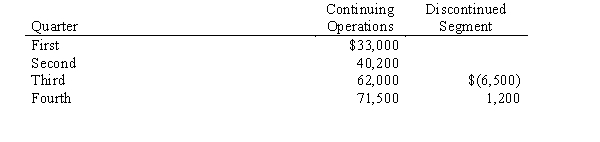

East Company, a highly diversified corporation, reports the results of operations quarterly. At the beginning of the third quarter, management decided to discontinue its recreational division. At this time, a formal plan was authorized, calling for disposal by year end. Results for the current year, excluding taxes, are as follows:

The following additional information was provided:

a.The first two quarters include results of operations of the discontinued segment. The segment reported first and second quarter pretax losses of $8,000 and $12,000, respectively.

b.The estimated annual income tax rate in the first and second quarters was 35%. Because of the decision to discontinue, the revised annual effective tax rate was determined to be 40%.Required:For each quarter, present the results of operations and the related tax expense or tax benefit. Where applicable, include the original and restated amounts in the presentation.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Saunders Corp., which accounts for inventory using

Q18: Non-ordinary items resulting in income or loss<br>A)include

Q19: Which of the following statements about interim

Q20: The incremental income tax effect utilized to

Q23: The management of Trident, Inc.is trying to

Q36: Adam Enterprise includes seven industry segments. Operating

Q37: Futura Corporation reported pretax net income of

Q39: If a company is utilizing LIFO inventory

Q53: When a company makes a second quarter

Q54: Stidham Company is a large international company