Multiple Choice

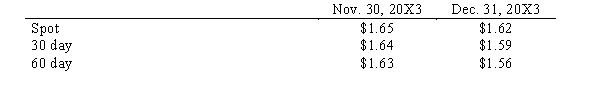

Hugh, Inc. purchased merchandise for 300,000 FC from a British vendor on November 30, 20X3. Payment in British pounds is due January 31, 20X4. Exchange rates to purchase 1 FC is as follows:  In the December 31, 20X3 income statement, what amount should Hugh report as foreign exchange gain from this transaction?

In the December 31, 20X3 income statement, what amount should Hugh report as foreign exchange gain from this transaction?

A) $3,000 loss

B) $9,000 gain

C) $9,000 loss

D) $3,000 gain

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Differentiate between the following monetary systems: floating

Q20: Wolters Corporation is a U.S. corporation that

Q22: On January 1, 20X1, a domestic firm

Q23: Wild, Inc. sold merchandise for 500,000 FC

Q26: Given the following information for a 90

Q27: On November 1, 20X1, a U.S. company

Q29: Rex Corporation, a U.S. firm with a

Q30: Which of the following statements is true

Q39: Which of the following does not represent

Q43: The best definition for direct quotes would