Multiple Choice

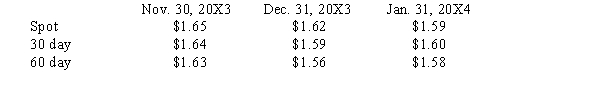

Happ, Inc. agreed to purchase merchandise from a British vendor on November 30, 20X3. The goods will arrive on January 31, 20X4 and payment of 100,000 British pounds is due at that time. On November 30, 20X3, Happ signed an agreement with a foreign exchange broker to buy 100,000 British pounds on January 31, 20X4. Exchange rates to purchase 1 British pound are as follows:  Because of this commitment hedge, Happ, Inc. will record the merchandise at what value when it arrives in January?

Because of this commitment hedge, Happ, Inc. will record the merchandise at what value when it arrives in January?

A) $165,000

B) $164,000

C) $163,000

D) $159,000

Correct Answer:

Verified

Correct Answer:

Verified

Q10: When an economic transaction is denominated in

Q20: Foreign currency transactions not involving a hedge

Q40: On January 1, 20X1, a U.S. firm

Q41: A U.S. Corp. purchased a computer from

Q43: Blue & Green, Inc. sold merchandise for

Q44: On August 1, 20X1, an American firm

Q47: The time value of an option is

Q48: On September 15, 20X2, Wall Company, a

Q49: A U.S. manufacturer has sold goods to

Q54: A U.S.manufacturer has sold computer services to