Essay

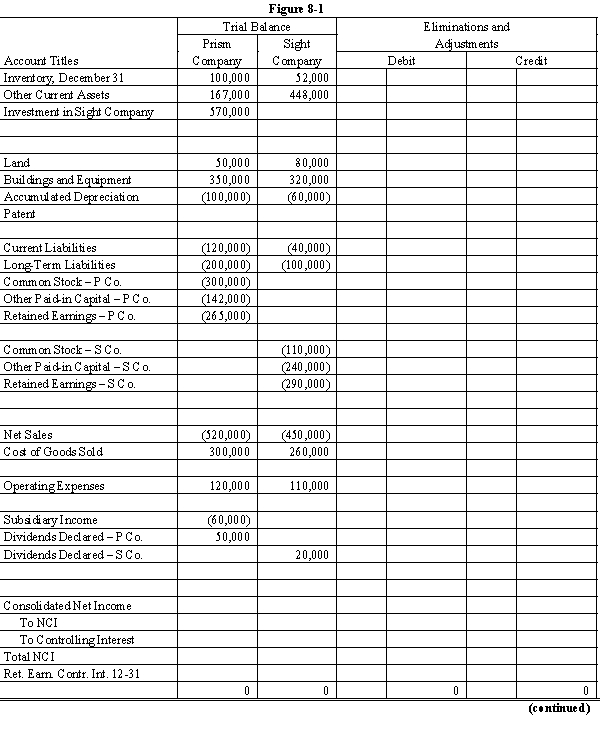

On January 1, 20X1, Prism Company purchased 7,500 shares of the common stock of Sight Company for $495,000. On this date, Sight had 20,000 shares of $10 par common stock authorized, 10,000 shares issued and outstanding. Other paid-in capital and retained earnings were $200,000 and $300,000 respectively. On January 1, 20X1, any excess of cost over book value is due to a patent, to be amortized over 15 years.

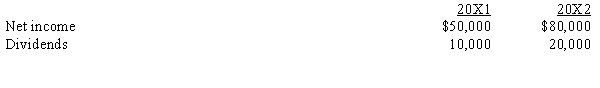

Sight's net income and dividends for two years were:

In November 20X1, Sight Company declared a 10% stock dividend at a time when the market price of its common stock was $50 per share. The stock dividend was distributed on December 31, 20X1.

For both 20X1 and 20X2, Prism Company has accounted for its investment in Sight Company using the simple equity method.

During 20X1, Sight Company sold goods to Prism Company for $40,000, of which $10,000 was on hand on December 31, 20X1. During 20X2, Sight sold goods to Prism for $60,000 of which $15,000 was on hand on December 31, 20X2. Sight's gross profit on intercompany sales is 40%.

Required:

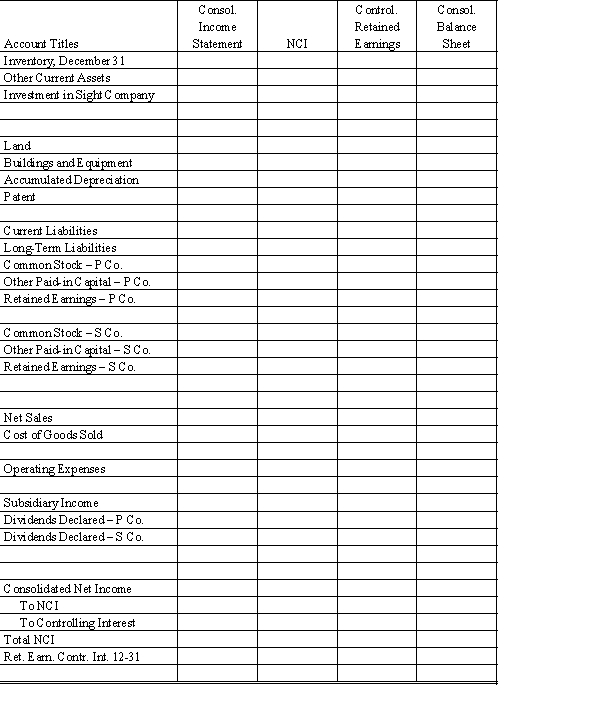

Complete the Figure 8-1 worksheet for consolidated financial statements for 20X2.

Correct Answer:

Verified

Determination and Distribution of Excess...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: Manke Company owns a 90% interest in

Q14: When a subsidiary owns shares of the

Q21: Two types of intercompany stock purchases significantly

Q27: Able Company owns an 80% interest in

Q32: On January 1, 20X1, Parent Company purchased

Q34: Apple Inc. purchased a 70% interest in

Q35: Plum Inc. acquired 90% of the capital

Q36: Plum Inc. acquired 90% of the capital

Q37: When the parent purchases some newly issued

Q38: A parent company owns a 100% interest