Essay

On January 1, 20X1, Parent Company purchased 85% of the common stock, 8,500 shares, of Subsidiary Company for $317,500. On this date, Subsidiary had common stock, other paid-in capital, and retained earnings of $50,000, $100,000, and $200,000 respectively. Any excess of cost over book value is due to goodwill.

On January 1, 20X2, Subsidiary purchased, from its noncontrolling shareholders, 1,000 shares of its common stock, 10% of the stock outstanding on that date. The price paid was $44,000.

Required (round all amounts to whole dollars; round percentages to one decimal: XX.X%)

a.Prepare an analysis to determine Parent's revised ownership interest following Sub's treasury stock transaction.

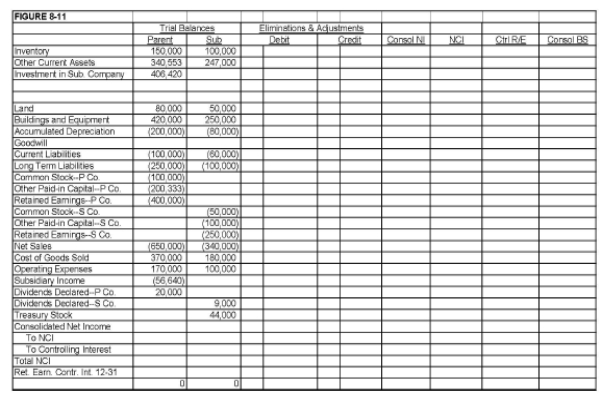

b.Complete the Figure 8-11 worksheet for consolidated financial statements for 20X2

Correct Answer:

Verified

a. Schedule to determine the change in P...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: On 1/1/X1 Poncho acquired an 80% interest

Q2: Pepper Company owned 60,000 of Salt Company's

Q3: On January 1, 20X1, Paris Ltd. paid

Q5: Pepper Company owns 60,000 of Salt Company's

Q7: Company P purchased a 80% interest in

Q8: Apple Inc. owns a 90% interest in

Q10: Consolidated statements for X, Y, and Z

Q10: On January 1, 20X1, Parent Company purchased

Q11: Pepper Company owned 60,000 of Salt Company's

Q41: When a parent purchases a portion of