Short Answer

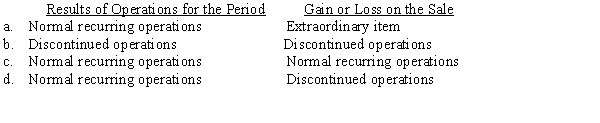

If the sale of an investment in a subsidiary is deemed to be a disposal of a component of the entity, the appropriate accounting treatments for the results its operations for the period and the gain or loss on the sale are:

Correct Answer:

Verified

B

If a subsidiary qualifies as a compone...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

If a subsidiary qualifies as a compone...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: When preparing a consolidated balance sheet worksheet

Q10: On January 1, 20X1, Pepper Company purchased

Q11: Pine Company purchased a 60% interest in

Q13: It is common for a parent firm

Q15: On January 1, 20X1, Patrick Company purchased

Q16: Which of the following is not true

Q17: On January 1, 20X1, Parent Company purchased

Q25: A parent company owns a 90% interest

Q26: When selling an investment in a subsidiary,

Q35: Which of the following statements is incorrect