Short Answer

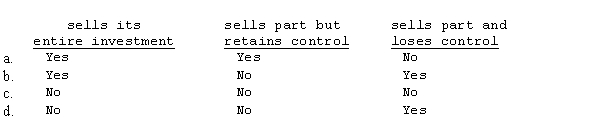

When a parent sells its subsidiary interest, a gain (loss) is recognized if the parent

Correct Answer:

Verified

B

When a parent sells its subsidiary int...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

B

When a parent sells its subsidiary int...

When a parent sells its subsidiary int...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q2: A new subsidiary is being formed.The parent

Q23: Pine Company purchased a 60% interest in

Q24: Pine Company purchased a 60% interest in

Q25: Company P owns an 90% interest in

Q26: Page Company purchased an 80% interest in

Q29: Partridge purchased a 60% interest in Sparrow

Q30: Saddle Corporation is an 80%-owned subsidiary of

Q31: Page Company purchased an 80% interest in

Q32: On January 1, 20X1, Poplar Company acquired

Q39: A subsidiary company may have preferred stock