Essay

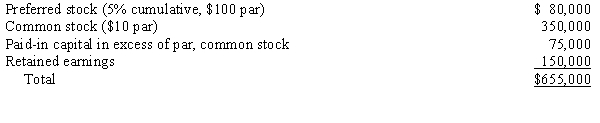

Pilatte Company acquired a 90% interest in the common stock of Sweet Company for $630,000 on January 1, 20X3, when Sweet Company had the following stockholders' equity:

The preferred stock dividends are 2 years in arrears. Any excess is attributable to equipment with a 5-year life, which is undervalued by $40,000, and to goodwill.

Required:

Prepare a determination and distribution of excess schedule for the investment in Sweet Company.

Correct Answer:

Verified

*$80,000 ...

*$80,000 ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: A new subsidiary is being formed.The parent

Q14: In the year a parent sells its

Q29: Partridge purchased a 60% interest in Sparrow

Q30: Saddle Corporation is an 80%-owned subsidiary of

Q31: Page Company purchased an 80% interest in

Q32: On January 1, 20X1, Poplar Company acquired

Q37: Page Company purchased an 80% interest in

Q38: A new subsidiary is being formed.The parent

Q38: Plant company owns 80% of the common

Q39: Partridge purchased a 60% interest in Sparrow