Essay

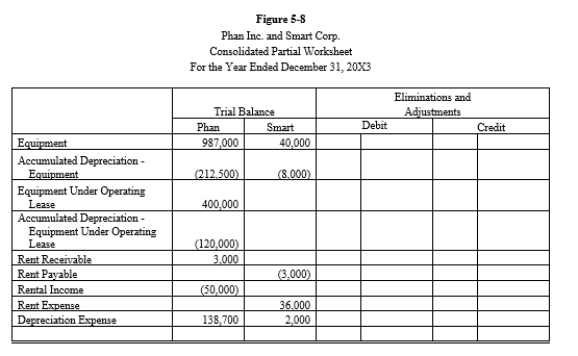

Smart Corporation is a 90%-owned subsidiary of Phan Inc. On January 2, 20X1, Smart agreed to lease $400,000 of construction equipment from Phan for $3,000 a month on an operating lease. The equipment has a 10-year life and is being depreciated using the straight-line method.

Required:

Prepare the eliminations and adjustments required by the intercompany lease on the Figure 5-8 partial worksheet for December 31, 20X3. Key and explain all eliminations and adjustments.

Correct Answer:

Verified

For the worksheet solution, please refer...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: Company P owns 80% of Company S.

Q8: Soap Company issued $200,000 of 8%, 5-year

Q10: Under a sales-type lease between affiliated companies,

Q13: What is recorded by the lessee and

Q15: Which of the following statements is true?<br>A)No

Q16: Tempo Industries is an 80%-owned subsidiary of

Q33: Company S is a 100%-owned subsidiary of

Q40: A subsidiary has outstanding $100,000 of 8%

Q45: When one member of a consolidated group

Q48: Company S is a 100%-owned subsidiary of