Essay

On January 1, 20X1, Parent Company acquired 100% of the common stock of Subsidiary Company for $365,000. On this date, Subsidiary had common stock, other paid in capital, and retained earnings of $50,000, $100,000, and $200,000 respectively. Any excess of cost over book value is due to goodwill. Parent uses the simple equity method to account for its investment in subsidiary.

On January 1, 20X2, Parent purchased equipment for $174,120 and immediately leased the equipment to Subsidiary on a 4-year lease. The transaction was legally structured as a sales-type lease with a present value for the minimum lease payments of $204,120. Parent recorded the following entry:

Minimum Lease Payments Receivable

240,000

Unearned Interest Income

35,880

Equipment

174,120

Sales Profit on Lease

30,000

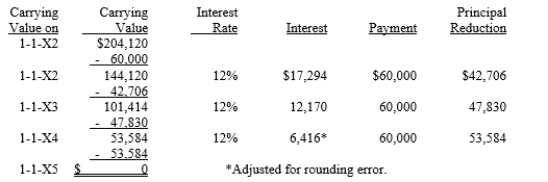

The minimum lease payments of $60,000 are to be made annually on January 1, beginning immediately, for a total of 4 payments. The implicit interest rate is 12%. The lease provides for an automatic transfer of title at the end of 4 years. The estimated useful life of the equipment is 6 years. The lease has been capitalized by both companies.

A lease amortization schedule, applicable to either company, is presented below:

Required:

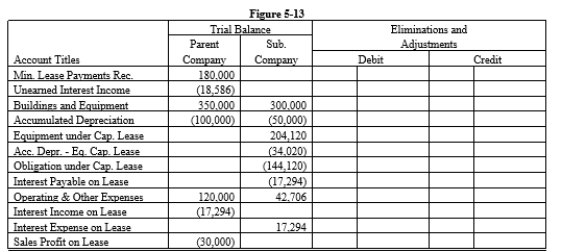

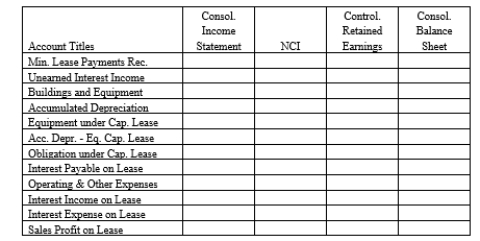

Prepare the eliminations and adjustments required by the intercompany lease on the Figure 5-13 partial worksheet as of December 31, 20X2. Key and explain all eliminations and adjustments.

Correct Answer:

Verified

For the parital worksheet solution, plea...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: The parent company leased a machine to

Q25: Soap Company issued $200,000 of 8%, 5-year

Q26: Company S is a 100%-owned subsidiary of

Q27: On January 1, 20X3, Pope Company acquired

Q27: Which of the following statements is true?<br>A)No

Q30: Powell Company owns an 80% interest in

Q31: The effect of an operating lease on

Q33: Sun Company is a 100%-owned subsidiary of

Q34: Lease terms can be considered to be

Q44: In years subsequent to the year one