Essay

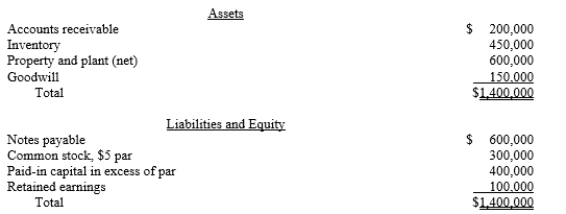

Supernova Company had the following summarized balance sheet on December 31 of the current year:

The fair value of the inventory and property and plant is $600,000 and $850,000, respectively.

Assume that Redstar Corporation exchanges 75,000 of its $3 par value shares of common stock, when the fair price is $20 per share, for 100% of the common stock of Supernova Company. Redstar incurred acquisition costs of $5,000 and stock issuance costs of $5,000.

Required:

a.What journal entries will Redstar Corporation record for the investment in Supernova and issuance of stock?

b.Prepare a supporting value analysis and determination and distribution of excess schedule

c.Prepare Redstar's elimination and adjustment entry for the acquisition of Supernova.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Discuss the conditions under which the SEC

Q13: On April 1, 20X1, Paape Company paid

Q14: On April 1, 20X1, Paape Company paid

Q15: Which of the following is true of

Q16: Consolidation might not be appropriate even when

Q17: Pinehollow acquired 80% of the outstanding stock

Q17: Consolidated financial statements are appropriate even without

Q20: On June 30, 20X1, Naeder Corporation purchased

Q21: On December 31, 20X1, Priority Company purchased

Q22: Consolidated financial statements are designed to provide:<br>A)informative