Short Answer

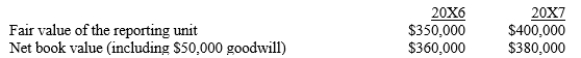

In performing the impairment test for goodwill, the company had the following 20X6 and 20X7 information available.  Assume that the carrying value of the identifiable assets are a reasonable approximation of their fair values. Based upon this information what are the 20X6 and 20X7 adjustment to goodwill, if any?

Assume that the carrying value of the identifiable assets are a reasonable approximation of their fair values. Based upon this information what are the 20X6 and 20X7 adjustment to goodwill, if any?

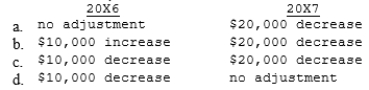

Correct Answer:

Verified

D

No imp...

No imp...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: Acquisition costs such as the fees of

Q20: A controlling interest in a company implies

Q32: ABC Co. is acquiring XYZ Inc. XYZ

Q35: Company B acquired the net assets of

Q36: Diamond acquired Heart's net assets. At the

Q37: Goodwill is an intangible asset.There are a

Q38: Orbit Inc. purchased Planet Co. on January

Q39: Publics Company acquired the net assets of

Q41: Poplar Corp. acquires the net assets of

Q42: On January 1, 20X1, Honey Bee Corporation