Essay

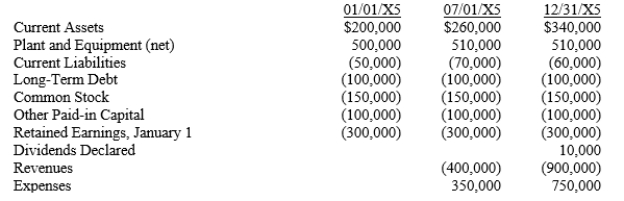

On January 1, July 1, and December 31, 20X5, a condensed trial balance for Nelson Company showed the following debits and (credits):

Assume that, on July 1, 20X5, Systems Corporation purchased the net assets of Nelson Company for $750,000 in cash. On this date, the fair values for certain net assets were:

Current Assets

$280,000

Plant and Equipment (remaining life of 10 years)600,000

Nelson Company's books were NOT closed on June 30, 20X5.

For all of 20X5, Systems' revenues and expenses were $1,500,000 and $1,200,000, respectively.

Required:

(1)Record the entry on Systems' books for the July 1, 20X5 purchase of Nelson.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Which of the following costs of a

Q8: Goodwill results when:<br>A)a controlling interest is acquired.<br>B)the

Q12: Vibe Company purchased the net assets of

Q14: One large Midwestern bank's acquisition of another

Q17: Cozzi Company is being purchased and has

Q18: A contingent liability of an acquiree<br>A)refers to

Q18: Jones company acquired Jackson Company for $2,000,000

Q20: ACME Co. paid $110,000 for the net

Q24: A large nation-wide bank's acquisition of a

Q40: When determining the fair values of assets