Short Answer

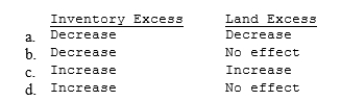

Company P Company uses the equity method to account for its January 1, 20X1, purchase of 30% of Company S's common stock. On January 1, 20X1, the market values of Company S's FIFO inventory and land exceed their book values. How do these excesses of market values over book values affect Company P's reported equity in Company S's 20X1 earnings?

Correct Answer:

Verified

B

The excess inventory will decrease inc...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

The excess inventory will decrease inc...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Assume that Company P purchases a 10%

Q3: Under the equity method of accounting, items

Q7: Company P purchased a 30% interest in

Q8: Company P purchased a 30% interest in

Q9: Per the FASB, all but the following

Q15: On January 1, 20X1, Company P purchased

Q20: Company P acquired 30% of Company S's

Q23: All but the following are required disclosures

Q24: Company P uses the sophisticated equity method

Q25: On January 1, 20X3, Company P purchased