Multiple Choice

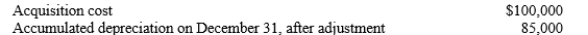

Equipment with an estimated residual value at acquisition of $15,000 was sold on December 31, for $20,000 cash. The following data were available at the time of sale:  When this transaction is recorded, it should include a

When this transaction is recorded, it should include a

A) debit of $80,000 to the Loss on Disposal account.

B) credit of $20,000 to the Equipment account.

C) credit of $5,000 to the Gain on Disposal account.

D) debit of $20,000 to the Accumulated Depreciation account.

Correct Answer:

Verified

Correct Answer:

Verified

Q41: Exeter Corporation purchased a piece of equipment

Q68: Fernbank Farms<br><br>This company purchased a semi truck

Q70: Natural resources can be replaced or restored

Q71: Two reasons why a company might choose

Q75: A company purchased equipment at the beginning

Q77: Farley Mills purchased new machinery at the

Q83: What is the relationship between the book

Q112: Select the account that would be increased

Q149: Exeter Corporation purchased a piece of equipment

Q170: Select the account that would be increased