Essay

The following unadjusted amounts were taken from a company's accounting records at December 31, 2019:

Note Payable, 6%, 4-month, dated December 1, 2019, for $500,000

Note Receivable, 12%, 6-month, dated October 1, 2019, for $400,000

A)Prepare any adjusting entries necessary at December 31, 2019, for the notes.

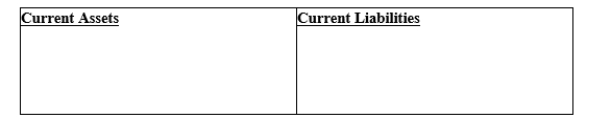

B)Fill in the partial balance sheet below by showing the notes and the effects of any adjustments related to the notes.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: An insurance company received advance payments from

Q9: The balance in the account, Rent Collected

Q10: The Cash account is never part of

Q11: Expenses should be matched against revenue<br>A)before the

Q12: When are revenues and expenses recognized in

Q14: What are adjusting entries and what is

Q15: Cambridge Cleaners started business on January 1,

Q16: Camper City started business on January 1,

Q18: Failure to record depreciation expense for the

Q119: Adjusting entries are recorded at the end