Essay

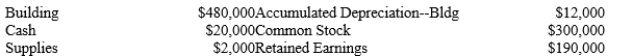

Can We Help?, a local walk-in medical practice, had the following account balances at December 31, 2019:  During 2020, the following transactions occurred:

During 2020, the following transactions occurred:

1.On March 1, purchased a one-year mal-practice insurance policy for $12,000 cash.

2.On July 1, borrowed $50,000 cash from First American Bank. The interest rate on the note payable is 8%. Principal and interest is due in cash in one year.

3.Employee salaries in the amount of $23,000 were paid in cash.

4.At the end of the year, $1,000 of the supplies remained on hand.

5.Provided $100,000 in consulting services for cash during 2013 in cash.

6.At December 31, $6,000 in employee salaries were accrued.

7.On December 31, received $10,000 in cash representing advance payment for services to be provided in February 2021.

8.Annual depreciation on the building is based on a useful life of 20 years and no salvage value.

Required:

A)Determine the effect on the accounting equation of the preceding transactions including any related year-end adjusting entries that may be required. Hint: It may be helpful to create a table to reflect the increases and decreases in accounts.

B)Prepare an income statement for 2020 ignoring income taxes.

C)Prepare a statement of retained earnings for 2020 assuming no dividends were paid.

D)Prepare a classified balance sheet at December 31, 2020.

Correct Answer:

Verified

Correct Answer:

Verified

Q154: Match each statement to the item listed

Q155: Match the following types of adjusting entries

Q156: <br>You are the owner and operator of

Q158: The difference between accrual-based revenue and accrual-based

Q160: Income statement accounts are also known as

Q161: The bookkeeper for City Rentals closed the

Q162: On December 31, 2019, a company signed

Q163: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2261/.jpg" alt=" -Refer to Cabana

Q164: The financial statements are prepared after<br>A)business transactions

Q168: Every adjustment involves at least one income