Essay

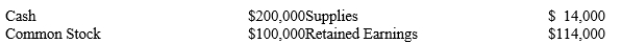

The accounting records of Cary's Magic Shows reflect the following account balances at January 1, 2019:  During 2019, the following transactions occurred:

During 2019, the following transactions occurred:

1.On February 1, rented a small office for a one year period of time. Paid $12,000 cash.

2.On November 1, received $3,600 cash for magic lessons to be provided evenly over November, December, and January.

3.By December 31, used 6,000 of the supplies.

4.At December 31, accrued $5,000 in wages and salaries.

5.During the year, paid cash for $25,000 in wages and salaries.

6.During the year, earned $65,000 cash in magic lesson revenue.

Required:

A)Determine the effect on financial statement accounts of the preceding transactions.

Hint: It may be helpful to create a table to reflect the increases and decreases in account.

B)Prepare an income statement for 2019 ignoring income taxes.

C)Prepare a classified balance sheet at December 31, 2019.

Correct Answer:

Verified

Correct Answer:

Verified

Q147: A _ results when cash is paid

Q148: Once adjustments have been made, an _

Q149: Match each statement to the item listed

Q150: The first step in the accounting cycle

Q151: Which of the following situations violates the

Q153: A calendar year company paid $24,000 on

Q154: Match each statement to the item listed

Q155: Match the following types of adjusting entries

Q156: <br>You are the owner and operator of

Q168: Every adjustment involves at least one income