Essay

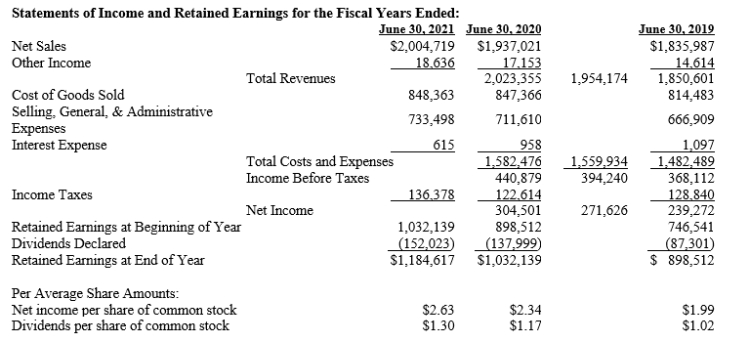

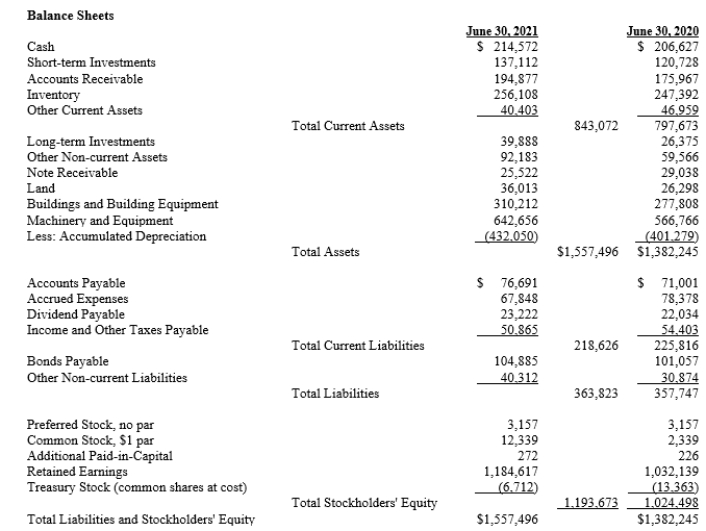

Recovery Solutions, Inc.Comparative financial statements are provided below:

-Refer to Recovery Solutions, Inc. Calculate the current ratio, quick ratio, and cash ratio for 2021. If you were a banker, would you lend money to this company under a short-term note payable?

Correct Answer:

Verified

Current ratio:

$843,072 current assets /...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

$843,072 current assets /...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q136: The net profit margin percentage reflects the

Q137: Which of the following statements is true

Q138: Selected data from the financial statements are

Q139: Red Oak Manufacturing<br>The following information is available

Q140: Match these terms to their correct definition.<br>-Length

Q142: Turnover ratios differ from the current and

Q143: Match these terms to their correct definition.<br>-An

Q144: For each of the following sentences, select

Q145: Earnings per share is an indication of

Q146: For each of the following sentences, select