Multiple Choice

Medstar Ambulance Service

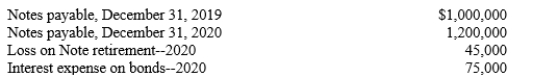

Information from the company's financial records is presented below:  At the end of 2020, the company issued notes at par value for $1,200,000 cash. The proceeds were used to retire the $1,000,000 note issue outstanding at the end of 2019 (before their maturity date) . All interest expense was paid in cash during 2020.

At the end of 2020, the company issued notes at par value for $1,200,000 cash. The proceeds were used to retire the $1,000,000 note issue outstanding at the end of 2019 (before their maturity date) . All interest expense was paid in cash during 2020.

-Refer to Medstar Ambulance Service. The following statements describe how the company reported the cash flow effects of the items described above on its 2020 statement of cash flows. The indirect method is used to prepare the operating activities section. Which of the following has been reported incorrectly?

A) Proceeds of $1,200,000 from the issuance of notes were reported as a cash inflow in the financing activities section.

B) The loss on note retirement of $45,000 was added to net income in the operating activities section.

C) Payments of $1,260,000 were reported as a cash outflow in the investing activities section.

D) Interest expense of $75,000 was not reported separately because it is included in net income in the operating activities section.

Correct Answer:

Verified

Correct Answer:

Verified

Q47: If the balance of wages payable increases

Q156: The statement of cash flows helps users

Q157: Which method of preparing the operating activities

Q158: The indirect method of reporting cash flows

Q159: Cash flows from issuing and repurchasing stock

Q160: When using the indirect method to determine

Q162: Unlike the income statement, no financial ratios

Q163: Under the indirect method, a gain from

Q164: Medstar Ambulance Service<br>Information from the company's financial

Q192: From the following choices, select the answer