Short Answer

Ladder Distributors

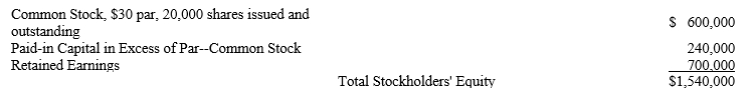

The stockholders' equity section of the December 31, 2019, balance sheet is provided below:

Assume that all of the 20,000 shares of stock that was issued as of December 31, 2019, was issued for $42 per share. On March 1, 2020, the company reacquired 4,000 shares of its common stock for $50 per share.

Assume that all of the 20,000 shares of stock that was issued as of December 31, 2019, was issued for $42 per share. On March 1, 2020, the company reacquired 4,000 shares of its common stock for $50 per share.

-Refer to Ladder Distributors. Suppose the company reissued 1,000 shares of its treasury stock on June 1, 2020, for $39 each. Which of the following is true regarding the entry required to record this transaction?

a.A debit to treasury stock is required for $50,000.

b.A credit to treasury stock is required for $39,000.

c.A debit to retained earnings is required for $11,000.

d.A debit to paid-in capital from treasury stock transactions is required for $3,000.

Correct Answer:

Answered by ExamLex AI

To answer this question, we need to unde...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Answered by ExamLex AI

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q88: Differentiate a cumulative dividend preference from a

Q89: If a corporation repurchases 500 shares of

Q90: No formal journal entry is required to

Q91: Labor Finders, Inc.<br>Selected data from the company's

Q92: When computing earnings per share, the numerator

Q94: The stockholders' equity section of a balance

Q95: _ represents the owners' claims against the

Q96: Match the following terms to their correct

Q97: Appropriations of retained earnings must be reported<br>A)in

Q98: When treasury stock is reissued at a