Not Answered

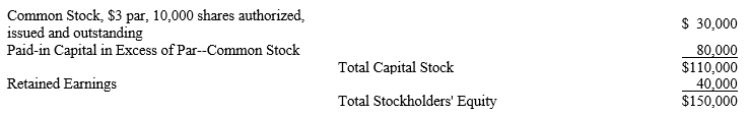

A corporation reported the following information at December 31, 2019:

A)On December 31, 2019, the board of directors issues a 3-for-1 stock split. What impact will the split have on the stock's par value?

B)What journal entry is required to record the split?

C)Record the declaration of a cash dividend of $1 per share on January 10, 2020. The dividend will be paid on January 31, 2020 to shareholders of record on January 24, 2020.

Correct Answer:

Verified

Correct Answer:

Verified

Q38: Dividends in arrears are required to be

Q39: Match the terms to the definitions.<br>-The preferred

Q40: Information from the stockholders' equity section of

Q41: A corporation has 5,000 shares of $5

Q42: An arbitrary monetary amount that has a

Q44: In July of 2020, the accountant discovered

Q45: A growing corporation had $180,000 of its

Q46: When a corporation pays a previously declared

Q47: Total stockholders' equity includes $50,000 of common

Q48: When a corporation declares a dividend, a