Not Answered

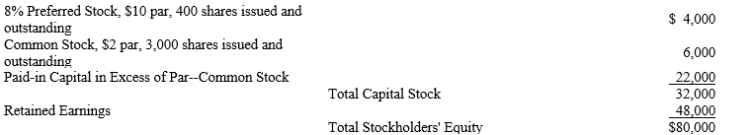

A corporation reported the following amounts on its balance sheet at December 1, 2019:  During December of 2019, the following transactions occurred:

During December of 2019, the following transactions occurred:

December 5

Declared and paid a 20% preferred stock dividend when the market price of the preferred stock was $12 per share.

December 21

Distributed a 2-for-1 stock split of the common stock when the market price of the common stock was $10 per share.

A)What journal entries are required to record these stock transactions?

B)How many preferred shares are outstanding at December 31, 2019?

C)How many common shares are outstanding at December 31, 2019?

D)What effect did the stock dividend have on the par value of the preferred stock?

E)What effect did the stock split have on the par value of the common stock?

Correct Answer:

Verified

Correct Answer:

Verified

Q162: On January 15, a corporation paid a

Q163: The stockholders' equity section of the balance

Q164: The following stockholders' equity information was available

Q165: If a corporation declares a 2-for-1 stock

Q166: Match the terms to the definitions.<br>-Authorization for

Q168: The stated value is the price at

Q169: On June 1, a board of directors

Q170: Earnings per share is an indication of

Q171: Preferred stockholders typically do not have the

Q172: Match the following terms to their correct