Multiple Choice

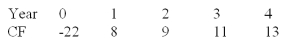

Using the technique of equivalent annual cash flows and a discount rate of 7%, what is the value of the following project?

A) 3.06

B) 3.61

C) 10.25

D) 12.23

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q53: Working capital is one of the most

Q55: How do you compare projects with different

Q58: Equivalent annual cash flow approach can be

Q59: A cash flow received in two years

Q60: The NPV value obtained by discounting nominal

Q61: Investment in inventories includes investment in:<br>I. Raw

Q62: For example, in the case of an

Q66: RainMan Inc. is in the business of

Q67: A firm has a general-purpose machine, which

Q68: A reduction in the sales of existing