Multiple Choice

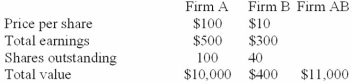

The following data on a merger is given:  Firm A has proposed to acquire Firm B at a price of $20 per share for Firm B's stock. Calculate the post merger P/E ratio assuming cash is used in the acquisition.

Firm A has proposed to acquire Firm B at a price of $20 per share for Firm B's stock. Calculate the post merger P/E ratio assuming cash is used in the acquisition.

A) 12.75

B) 6.25

C) 13.75

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q19: Diversification is a very sensible reason for

Q63: A conglomerate merger is one in which

Q64: Briefly explain what is meant by "the

Q65: Suppose that the market price of Company

Q66: Briefly explain the different types of mergers.

Q67: The merger of Pfizer and Wyeth is

Q69: The acquisition of stock has the advantage

Q70: If an acquisition is made using cash

Q71: The following are good reasons for mergers:<br>I.

Q73: The following are industries in which large