Multiple Choice

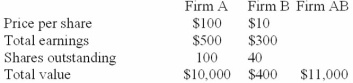

The following data on a merger is given:  Firm A has proposed to acquire Firm B at a price of $20 per share for Firm B's stock. What will earnings per share be for Firm A after the merger assuming that cash is used in the acquisition?

Firm A has proposed to acquire Firm B at a price of $20 per share for Firm B's stock. What will earnings per share be for Firm A after the merger assuming that cash is used in the acquisition?

A) $6

B) $7

C) $8

D) $5

Correct Answer:

Verified

Correct Answer:

Verified

Q2: The following are methods available to change

Q20: Who are antitakeover defenses designed to protect?

Q42: The main difference in a tax-free versus

Q43: Firm A has a value of $100

Q46: Briefly discuss different forms of acquisition.

Q48: Given the following data: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2525/.jpg" alt="Given

Q50: What are the tax consequences of a

Q51: Given the following data:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2525/.jpg" alt="Given the

Q52: Bank of America and Merrill Lynch merger

Q74: Supermajorities give shareholders more control over the