Essay

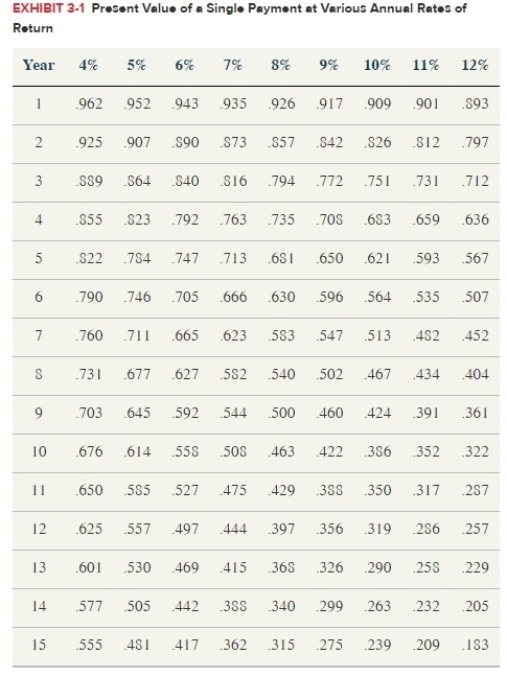

Based only on the information provided for each scenario, determine whether Kristi or Cindy will benefit more from using the timing strategy and why there will be a benefit to that person. Use Exhibit 3.1.  a. Kristi has a 40% tax rate and can defer $20,000 of income. Cindy has a 30% tax rate and can defer $30,000 of income.b. Kristy has a 30% tax rate, a 10% after-tax rate of return, and can defer $25,000 of income for three years. Cindy has a 40% tax rate, an 8% after-tax rate of return, and can defer $20,000 of income for four years.

a. Kristi has a 40% tax rate and can defer $20,000 of income. Cindy has a 30% tax rate and can defer $30,000 of income.b. Kristy has a 30% tax rate, a 10% after-tax rate of return, and can defer $25,000 of income for three years. Cindy has a 40% tax rate, an 8% after-tax rate of return, and can defer $20,000 of income for four years.

Correct Answer:

Verified

(A) CINDY, BECAUSE SHE CAN DEF...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: Assume that Lucas' marginal tax rate is

Q12: Investing in municipal bonds to avoid paying

Q13: A taxpayer instructing her son to collect

Q16: Sal, a calendar year taxpayer, uses the

Q17: Nontax factors do not play an important

Q18: Joe Harry, a cash basis taxpayer, owes

Q23: Tax avoidance is a legal activity that

Q59: Lucinda is contemplating a long-range planning strategy

Q91: The value of a tax deduction is

Q134: The constructive receipt doctrine is more of