Essay

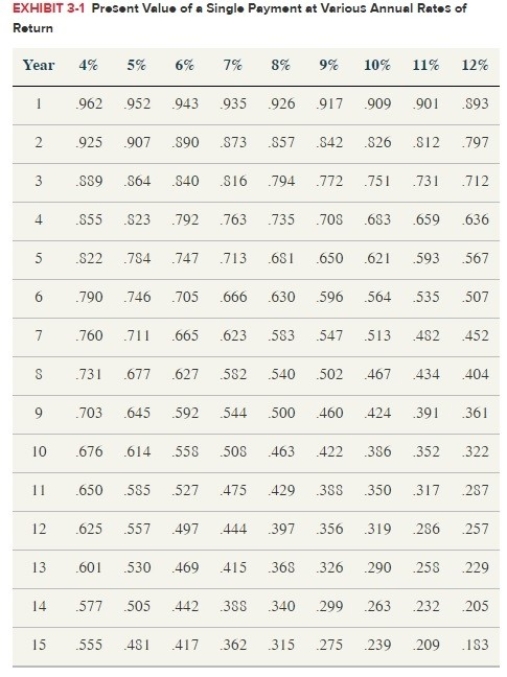

O'Reilly is a masterful lottery player. The megamillion jackpot is now up to $200 million. IfO'Reilly wins the jackpot, he has a choice of receiving $200 million in 5 years or a smaller lumpsum currently. Advise O'Reilly on his choice under the following scenarios. Which option should he take and why? Use Exhibit 3.1.  a. O'Reilly's after-tax return is 10%. If he chooses the current lump sum option, the lottery will pay him $130 million.b. O'Reilly's after-tax return is 10%. His current tax rate will be 35% if he receives the lottery payment now. His expected tax rate in five years will be 40%. If he chooses the current lump sum option, the lottery will pay him $100 million.

a. O'Reilly's after-tax return is 10%. If he chooses the current lump sum option, the lottery will pay him $130 million.b. O'Reilly's after-tax return is 10%. His current tax rate will be 35% if he receives the lottery payment now. His expected tax rate in five years will be 40%. If he chooses the current lump sum option, the lottery will pay him $100 million.

Correct Answer:

Verified

(A) IF O'REILLY TAKES THE CURRENT LUMP S...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q14: In general, tax planners prefer to accelerate

Q31: Richard recently received $10,000 of compensation for

Q44: Compare and contrast the constructive receipt doctrine

Q60: Which of the following is an example

Q61: Which is not a basic tax planning

Q63: Which of the following does not limit

Q65: Assume that Will's marginal tax rate is

Q67: If Jim invested $100,000 in an annual-dividend

Q68: Jason's employer pays year-end bonuses each year

Q98: There are two basic timing-related tax rate