Short Answer

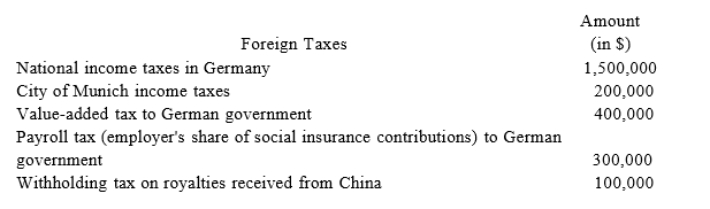

Rainier Corporation, a U.S. corporation, manufactures and sells quidgets in the United States and Europe. Rainier conducts its operations in Europe through a German GmbH, which the company elects to treat as a branch for U.S. tax purposes. Rainier also licenses the rights to manufacturequidgets to an unrelated company in China. During the current year, Rainier paid the following foreigntaxes, translated into U.S. dollars at the appropriate exchange rate:  What amount of creditable foreign taxes does Rainier incur?

What amount of creditable foreign taxes does Rainier incur?

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Which of the following exceptions could cause

Q2: Pierre Corporation has a precredit U.S. tax

Q4: Which statement best describes the U.S. framework

Q7: Manchester Corporation, a U.S. corporation, incurred $100,000

Q8: Under which of the following scenarios could

Q10: Alhambra Corporation,a U.S.corporation,receives a dividend from its

Q10: Ames Corporation has a precredit U.S. tax

Q11: Gwendolyn was physically present in the United

Q32: Orleans Corporation,a U.S.corporation,manufactures boating equipment.Orleans reported sales

Q57: Hazelton Corporation,a U.S.corporation,manufactures golf equipment.Hazelton reported sales