Multiple Choice

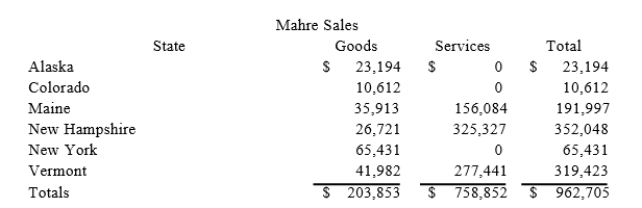

Assume the following sales tax rates: Alaska (6.6 percent) , Colorado (7.75 percent) , Maine (8.5 percent) , New Hampshire (6.75 percent) , New York (8 percent) , and Vermont (5 percent) . How much sales and use tax must Mahre collect and remit in Maine?

Assume the following sales tax rates: Alaska (6.6 percent) , Colorado (7.75 percent) , Maine (8.5 percent) , New Hampshire (6.75 percent) , New York (8 percent) , and Vermont (5 percent) . How much sales and use tax must Mahre collect and remit in Maine?

A) $13,267.

B) $0.

C) $16,319.

D) $3,053.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Separate return states require each member of

Q14: Most state tax laws adopt the federal

Q34: Businesses must collect sales tax only in

Q67: Public Law 86-272 protects only companies selling

Q92: The Quill decision reaffirmed that out-of-state businesses

Q93: Which of the following is not a

Q98: Hoosier Incorporated is an Indiana corporation. It

Q100: All 50 states impose a sales and

Q108: Purchases of inventory for resale are typically

Q118: Giving samples and promotional materials without charge