Multiple Choice

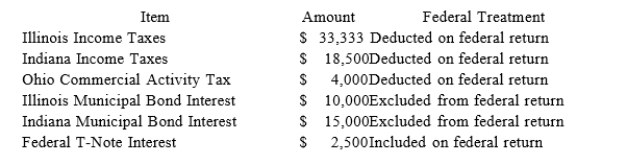

PWD Incorporated is an Illinois corporation. It properly included, deducted, or excluded the80) following items on its federal tax return in the current year:  PWD's Federal Taxable Income was $100,000. Calculate PWD's Illinois state tax base.

PWD's Federal Taxable Income was $100,000. Calculate PWD's Illinois state tax base.

A) $131,000.

B) $116,000.

C) $164,333.

D) $130,833.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: List the steps necessary to determine an

Q14: Most state tax laws adopt the federal

Q19: Federal/state adjustments correct for differences between two

Q42: The property factor is generally calculated as

Q60: Super Sadie,Incorporated manufactures sandals and distributes them

Q103: Which of the following isn't a typical

Q104: Roxy operates a dress shop in Arlington,

Q106: Which of the following sales is always

Q110: Which of the following businesses is likely

Q111: Wendy is a Wisconsin Corporation and has