Essay

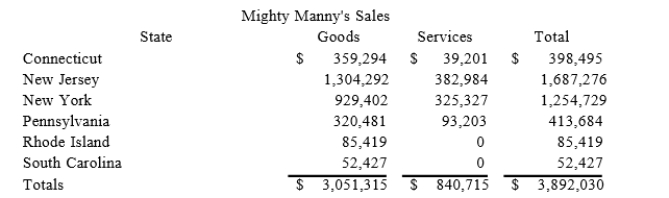

Mighty Manny, Incorporated manufactures and services deli machinery and distributes them across theUnited States. Mighty Manny is incorporated and headquartered in New Jersey. It has sales and use tax nexus in Connecticut, New Jersey, New York, Pennsylvania, Rhode Island, and South Carolina. Mighty Manny has sales as follows:  Assume the following sales tax rates: Connecticut (6.75 percent), New Jersey (7.5 percent), New York (8.5 percent), Pennsylvania (6.5 percent), Rhode Island (7.25 percent), and South Carolina (5.5 percent). Assume that Connecticut also taxes Mighty Manny's services. What is Mighty Manny's total sales and use taxliability?

Assume the following sales tax rates: Connecticut (6.75 percent), New Jersey (7.5 percent), New York (8.5 percent), Pennsylvania (6.5 percent), Rhode Island (7.25 percent), and South Carolina (5.5 percent). Assume that Connecticut also taxes Mighty Manny's services. What is Mighty Manny's total sales and use taxliability?

Correct Answer:

Verified

$233,626.

($398,495 × 6.75 per...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

($398,495 × 6.75 per...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: Failure to collect and remit sales taxes

Q24: Big Company and Little Company are both

Q38: The throwback rule requires a company,for apportionment

Q42: Gordon operates the Tennis Pro Shop in

Q52: Immaterial violations of the solicitation rules automatically

Q62: The sales and use tax base varies

Q74: The primary purpose of state and local

Q82: Public Law 86-272 protects a taxpayer from

Q91: Which of the following is incorrect regarding

Q111: Most services are sourced to the state