Essay

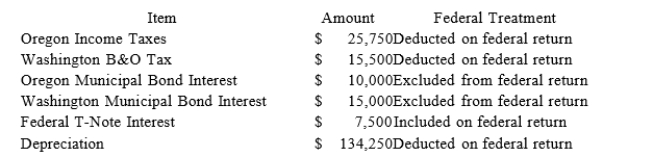

Moss Incorporated is a Washington corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:  Moss' Oregon depreciation was $145,500. Moss' Federal Taxable Income was $549,743. Calculate Moss' Oregon state tax base.

Moss' Oregon depreciation was $145,500. Moss' Federal Taxable Income was $549,743. Calculate Moss' Oregon state tax base.

Correct Answer:

Verified

$571,743.

$549,743 +...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

$549,743 +...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: The state tax base is computed by

Q7: Interest and dividends are allocated to the

Q14: Tennis Pro,a Virginia Corporation domiciled in Virginia,has

Q20: Gordon operates the Tennis Pro Shop in

Q61: What was the Supreme Court's holding in

Q62: Which of the following isn't a requirement

Q63: Roxy operates a dress shop in Arlington,

Q66: Which of the following regarding the state

Q136: Public Law 86-272 protects certain business activities

Q139: Business income includes all income earned in