Short Answer

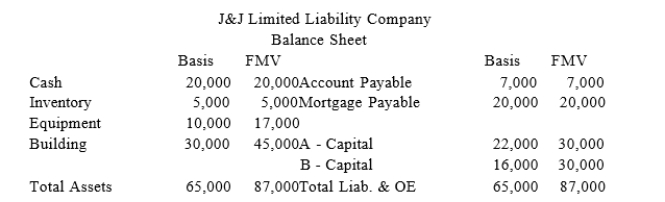

J&J, LLC was in its third year of operations when J&J decided to expand the number of members from two, A & B, with equal profits and capital interests to three members, A, B, and C. The third member, C, will contribute her financial expertise to the LLC in exchange for a 1/3 capital interestin J&J. Given the balance sheet below reflecting the financial position of J&J on the date member C is admitted, what are the tax consequences to members A, B, and C, and to J&J when C receives her capitalinterest? If, instead, member C receives a 1/3 profit interest, what would be the tax consequences to membersA, B, and C, and to J&J?

Correct Answer:

Verified

$9,000.

C ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

C ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q28: Guaranteed payments are included in the calculation

Q57: Actual or deemed cash distributions in excess

Q60: Which of the following does not represent

Q62: For partnership tax years ending after December

Q62: Tom is talking to his friend Bob,

Q64: What is the rationale for the specific

Q68: XYZ, LLC has several individual and corporate

Q69: Which of the following would not be

Q70: Which of the following statements exemplifies the

Q92: A purchased partnership interest has a holding