Essay

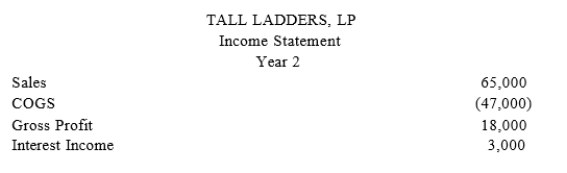

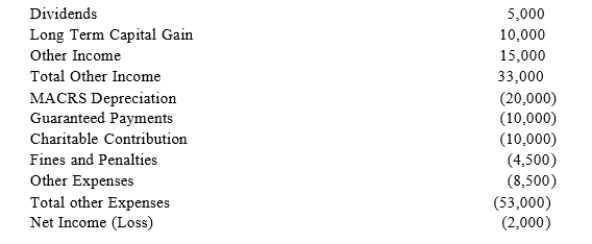

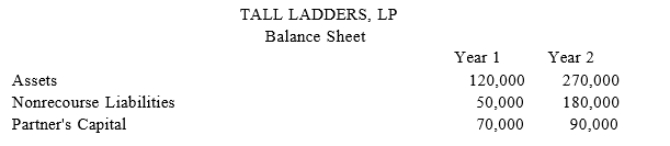

At the end of year 1, Tony had a tax basis of $40,000 in Tall Ladders, Limited Partnership. Tony has a 20 percent profits interest in Tall Ladders. For year 2, Tall Ladders will pay Tony a $10,000guaranteed payment for extra services he provides to the partnership. Given the following IncomeStatement and Balance Sheet from Tall Ladders, what is Tony's adjusted tax basis at the end of year 2?

Correct Answer:

Verified

*Note that guaranteed payments...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: Jordan, Inc., Bird, Inc., Ewing, Inc., and

Q10: A partnership with a C corporation partner

Q12: Under proposed regulations issued by the Treasury

Q13: How does additional debt or relief of

Q14: Jerry, a partner with 30% capital and

Q49: On April 18, 20X8, Robert sold his

Q57: This year, Reggie's distributive share from Almonte

Q94: An additional allocation of partnership debt or

Q116: Why are guaranteed payments deducted in calculating

Q127: A partnership can elect to amortize organization