Essay

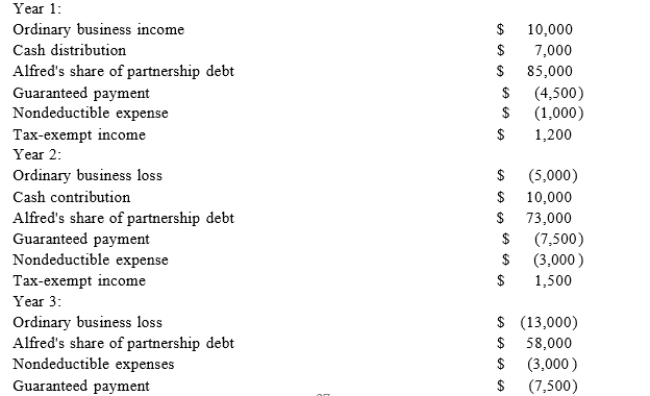

Alfred, a one-third profits and capital partner in Pizzeria Partnership needs help in adjusting his tax basis to reflect the information contained in his most recent Schedule K-1 from the partnership. Unfortunately, the Schedule K-1 he recently received was for year 3 of the partnership, but Alfredonly knows that his tax basis at the beginning of year 2 of the partnership was $23,000. Thankfully, Alfred still has his Schedule K-1 from the partnership for years 1 and 2.Using the following information from Alfred's year 1, year 2, and year 3 Schedule K-1, calculate his tax basis the end of year 2 and year 3.

Correct Answer:

Verified

At the end of year 2, Alfred's...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: The main difference between a partner's tax

Q29: Which of the following items are subject

Q30: Which of the following statements regarding partnerships

Q31: John, a limited partner of Candy Apple,

Q32: Which requirement must be satisfied in order

Q33: What type of debt is not included

Q36: KBL, Inc., AGW, Inc., Blaster, Inc., Shiny

Q38: Styling Shoes, LLC filed its 20X8 Form

Q39: In what order should the tests to

Q49: Income earned by flow-through entities is usually