Essay

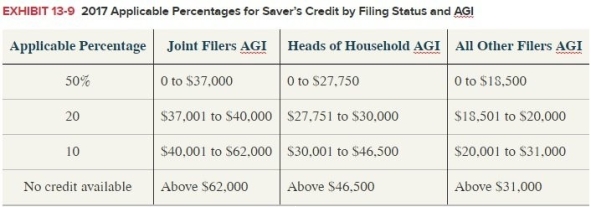

Deborah (single, age 29) earned $25,000 in 2017. Deborah was able to contribute $1,800($150/month) to her employer sponsored 401(k). What is the total saver's credit that Deborah can claim for 2017? Exhibit 13-9

Correct Answer:

Verified

$180

$1,800 (contribution amou...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

$1,800 (contribution amou...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: Tatia, age 38, has made deductible contributions

Q48: On December 1,2017 Irene turned 71 years

Q59: A taxpayer can only receive a saver's

Q93: Tyson (48 years old) owns a traditional

Q95: Which of the following statements regarding IRAs

Q98: Employee contributions to traditional 401(k)accounts are deductible

Q100: Which of the following describes a defined

Q101: Which of the following statements regarding self-employed

Q103: Which of the following is true concerning

Q141: Defined benefit plans specify the amount of